More About Paypal Business Loan

Wiki Article

The smart Trick of Paypal Business Loan That Nobody is Talking About

Table of ContentsExamine This Report about Paypal Business LoanThe Facts About Paypal Business Loan RevealedThe Buzz on Paypal Business LoanPaypal Business Loan for BeginnersThe Definitive Guide to Paypal Business Loan

You'll have multiple alternatives when checking out startup finances, consisting of SBA finances, tools financing, credit lines, short-term loans, and business charge card. The payments will certainly be based upon the amount of the lending, along with the rate of interest, term, and collateral. To certify, it's usually needed to have a credit rating of 680 or higher.With an organization acquisition financing, you'll get anywhere from $5,000 to $5,000,000. The terms can be rotating or for 10-25 years. The funds will not show up specifically quick, generally taking regarding a month to strike your account. One of the very best elements of these car loans is that rates of interest start as low as 5 (PayPal Business Loan).

These desirable prices indicate you'll conserve a substantial quantity of money over the life time of the loan. Obtaining an organization acquisition loan can provide a jumpstart to your organization, as acquiring a franchise business or existing organization is an excellent means to tip right into an useful company without the gruelling job of constructing it from the ground up.

While the application varies relying on whether you're purchasing a franchise business or existing organization, you can prepare on lending institutions assessing factors such as your credit report, organization period, and earnings. You'll require to give records of the service's performance as well as valuation, in addition to your very own business strategy and also financial projections.

The Buzz on Paypal Business Loan

There's no worry with your organization lugging financial obligation. The concern is whether your organization can manage its financial obligation commitments. To get a bead on your business financial obligation protection, a lender evaluate your capital and also financial debt payments. If you're carrying individual debt, you remain in great firm. Regarding 80% of Americans have some type of financial obligation.

To get this metric, a lender will split your arrearage by the cumulative amount of your readily available rotating credit scores. Lenders likewise appreciate the state of your business financial obligation (PayPal Business Loan). Having financial debt isn't a big bargain. What matters is whether the amount of debt you're carrying is proper contrasted to the dimension of your company as well as the industry you're operating in.

The Definitive Guide for Paypal Business Loan

Lenders are more inspired to work with you if your organization is trending in the right instructions, so they'll wish to establish what your average profits growth will certainly be over time. If yours lands at or above the average for your market, you remain in wonderful shape. If you fall below the standard, plan on there being some feasible difficulties in your quest of funding.There are several sorts of small-business financings every little thing from an organization line of credit report to billing factoring to seller cash loan each with its own advantages and disadvantages. The appropriate one for your business will rely on when you need the cash as well as what you require it for. Right here are the 10 most-popular sorts of company loans.

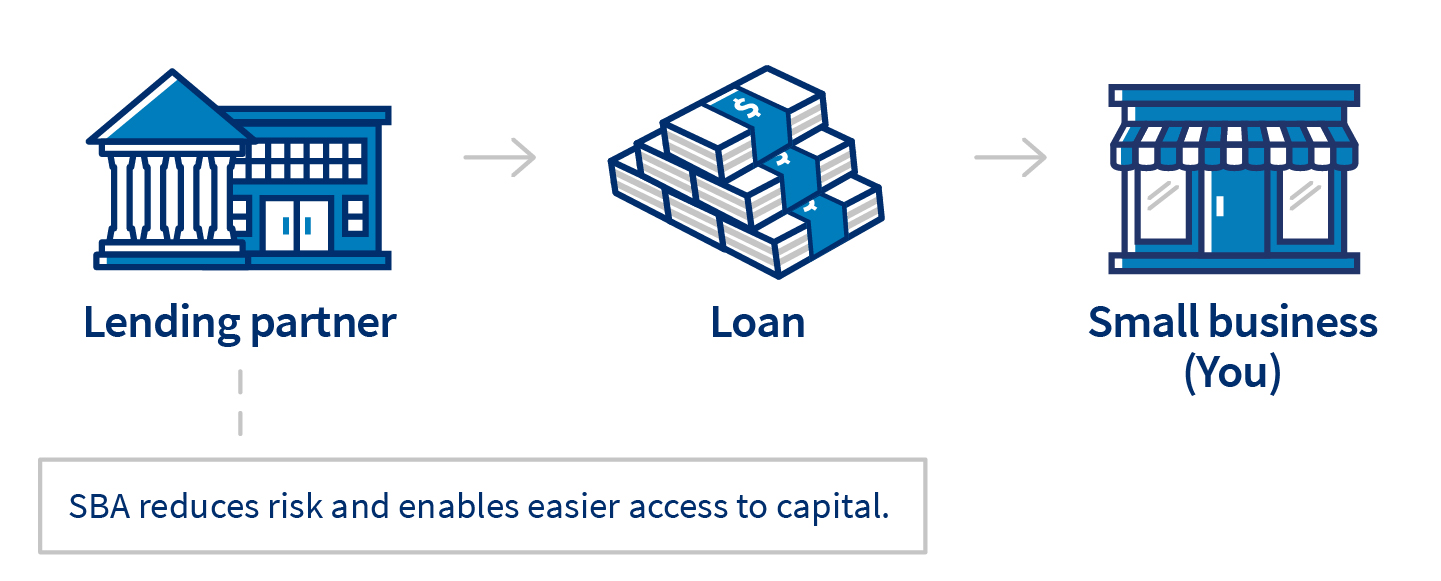

Best for: Businesses looking to increase. The Small Service Administration assures these lendings, which are provided by banks as well as various other lending institutions.

Prices will certainly depend on the worth of the equipment as well as the toughness of your organization. You can obtain affordable prices if you have strong credit rating and also organization funds.

The Best Strategy To Use For Paypal Business Loan

Cons: Smaller sized finance amounts. Best for: Start-ups and companies in deprived areas.As we have actually talked about, there are several various sorts of company loansand the check this appropriate one for your business ultimately comes down to a number of elements. At the end of the day, each sort of tiny business loan is designed for a different service requirement. You'll require to consider your credit rating, your service's funds, the length of time you've been operating, as well as your reason for the funding prior to narrowing down your choices.

You'll also learn regarding a number of options that you can take benefit of if a little service funding is not your best financing choice. There are specific things that every local business proprietor must understand before heading down the application process. Below are the 5 main truths to know: They're all various.

The Only Guide for Paypal Business Loan

There are a great deal of frauds. Know your financial debt solution protection proportion. Prepare to back your company. Allow's get going: Bank loan are as varied as the tiny service owners that look for them. Not every lender works in the exact same fashion, as well as also within the same financing business, you'll locate anchor various types of car loans.Report this wiki page